city of richmond property tax rate

The real estate tax is the result of multiplying the FMV of the property times the real estate tax rate. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered.

:format(webp)/https://www.thestar.com/content/dam/localcommunities/richmond_hill_liberal/news/2021/12/12/richmond-hill-council-delivers-second-consecutive-property-tax-freeze/10536070_FGLLru2VgA00vFi.jpg)

Richmond Hill Council Delivers Second Consecutive Property Tax Freeze The Star

To pay your 2019 or newer property taxes online.

. 239 West Main St. These agencies provide their required tax rates and the City collects the taxes on their behalf. Search by Property Address Search property based on street address If you have difficulty in accessing any data you may contact our customer service group by calling 804 646-7000.

In Person at City Hall. Other Services Adopt a pet. 2022 Tax Digest and Levy 5-Year History.

Richmond KY 40475 859 623-1000 Justice Education Industry Finance. The real estate tax is the result of multiplying the FMV of the property times the real estate tax rate. The Mayor and Council of the City of Richmond Hill do hereby.

Property Taxes are due once a year in Richmond on the first business day of July. The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800. Drop Box at City Hall.

The City Assessor determines the FMV of over 70000 real property parcels each year. Building Department. Property tax payments may be paid by cheque bank draft.

City of Richmond 2019 and newer property taxes real estate and personal property are billed and collected by the Ray County Collector. Manage Your Tax Account. Due Dates and Penalties for Property Tax.

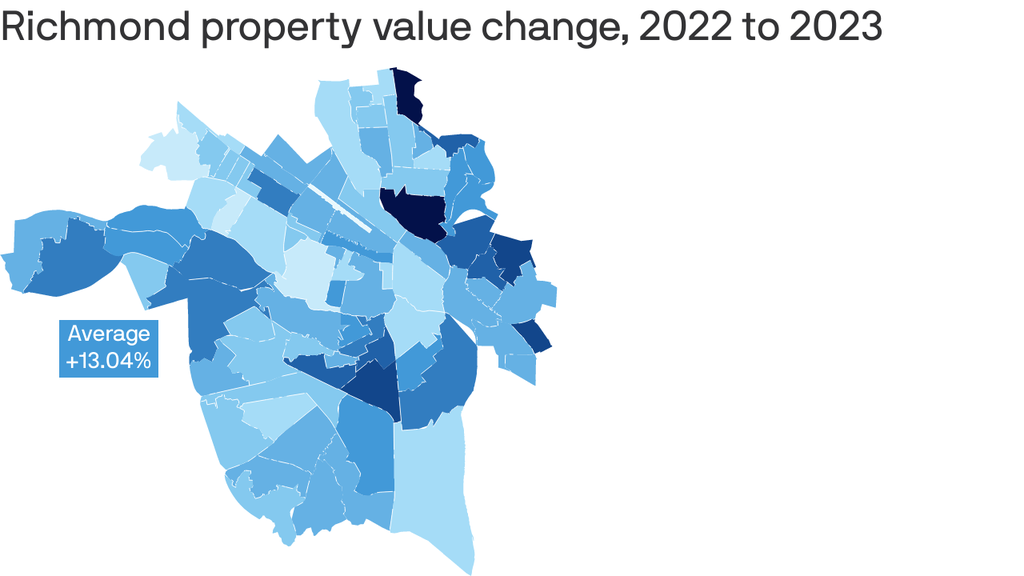

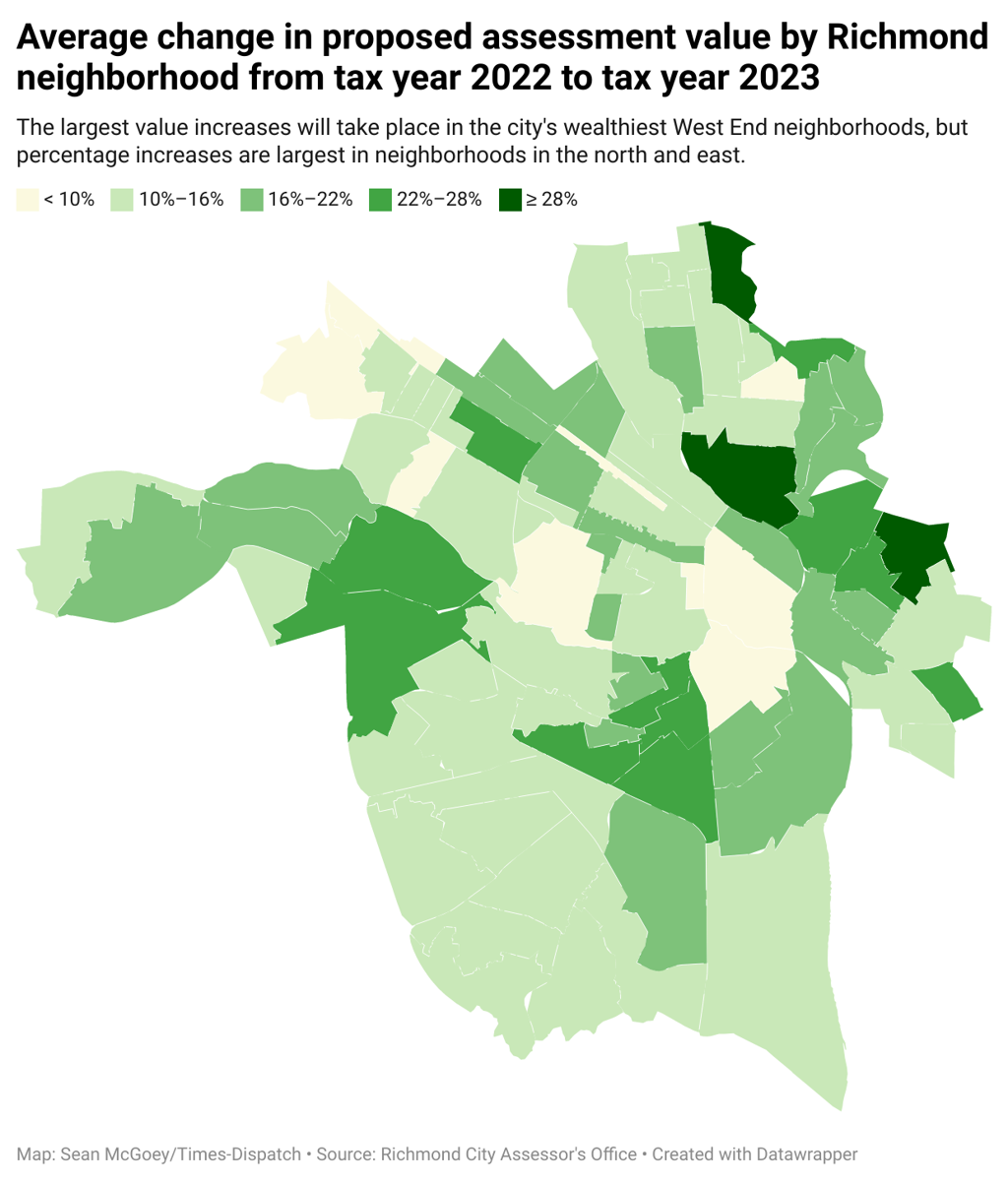

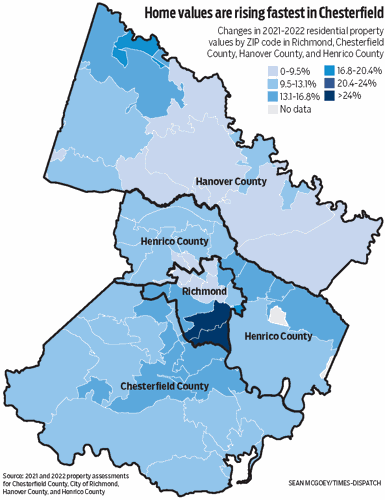

Richmond City Council is considering lowering the real property tax rate as property values across the city increased 13 on average from a year prior. Richmond City collects on average 105 of a propertys. Understanding Your Tax Bill.

Online Credit Card Payment Service Fees Apply Pay property taxes and utilities by credit card through the Citys website. It is estimated that by freezing the rate the city will provide Richmonders more than. Real Estate and Personal Property Taxes Online Payment.

Building Department. Electronic Check ACHEFT 095. 295 with a minimum of 100.

Paying Your Property Taxes. City of Richmond Hill Property Tax. Depending on your vehicles value you may save up to 150 more because the city is freezing the rate.

Property Tax Vehicle Real Estate Tax. These documents are provided in Adobe Acrobat PDF format for printing. For information and inquiries regarding amounts levied by other taxing authorities.

Richmond residents will have until July 4 to pay their property taxes. The City of Richmond is not accepting property tax payments in cash until March 31 2021 due to pandemic safety measures. The City Assessor determines the FMV of over 70000 real property parcels each year.

RICHMOND CITY HALL 450 Civic Center Plaza Richmond CA 94804. The current millage rate is 4132. Mon day July 4 2022.

Deadline To Pay Richmond Property Taxes Approaching Richmond News

Richmond Sees Another Year Of Double Digit Percentage Increases In Property Tax Assessments

Newton City Council Sets 2022 Property Tax Rates Newton Ma Patch

Petersburg Real Estate Values Increase 13 Since Last Year

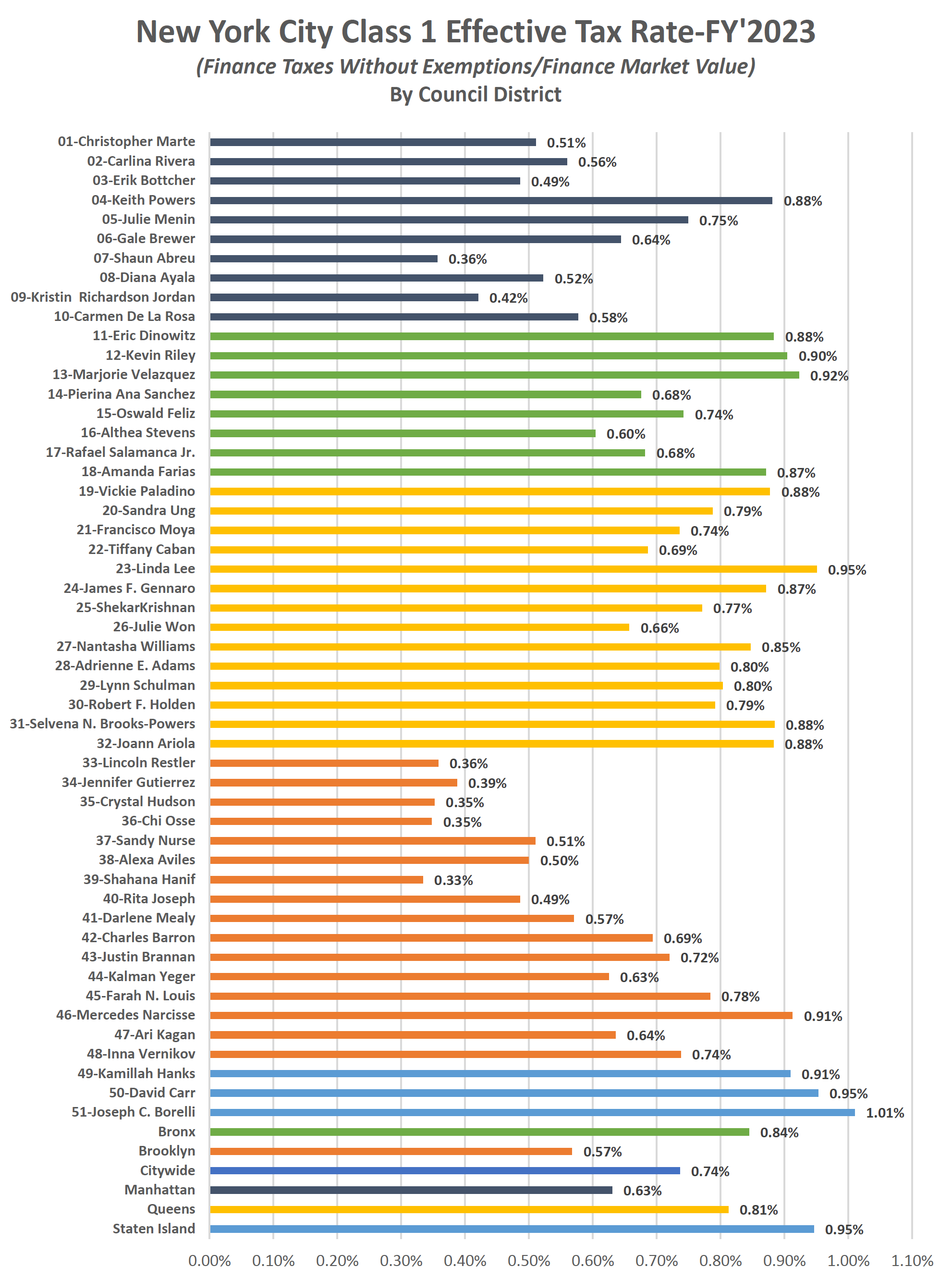

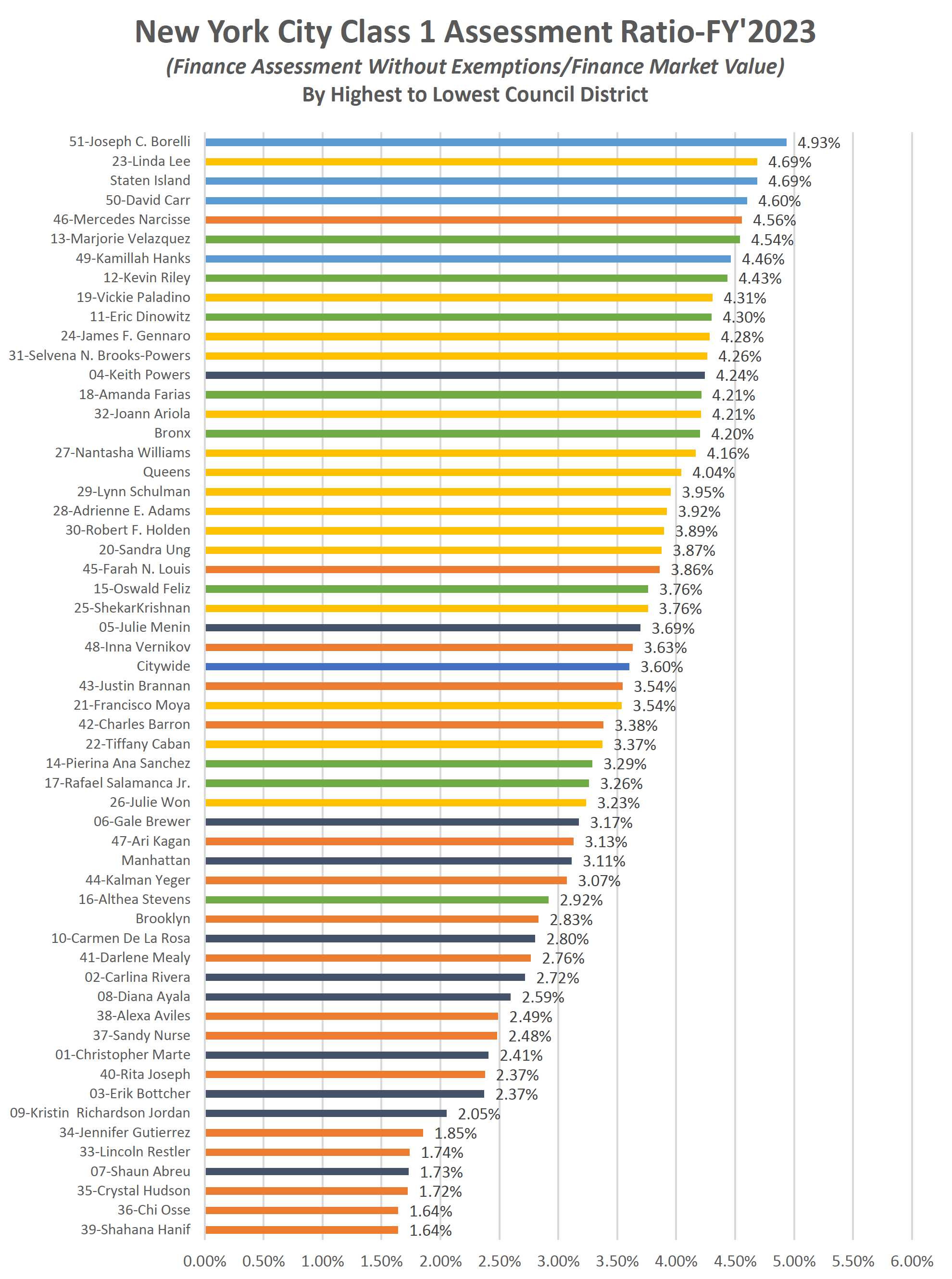

Issue 1 The New York City Property Tax System Discriminates Against Residents Of Majority Minority Neighborhoods Tax Equity Now

Houston Property Tax Rates By Cutmytaxes Issuu

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

Virginia Property Tax Calculator Smartasset

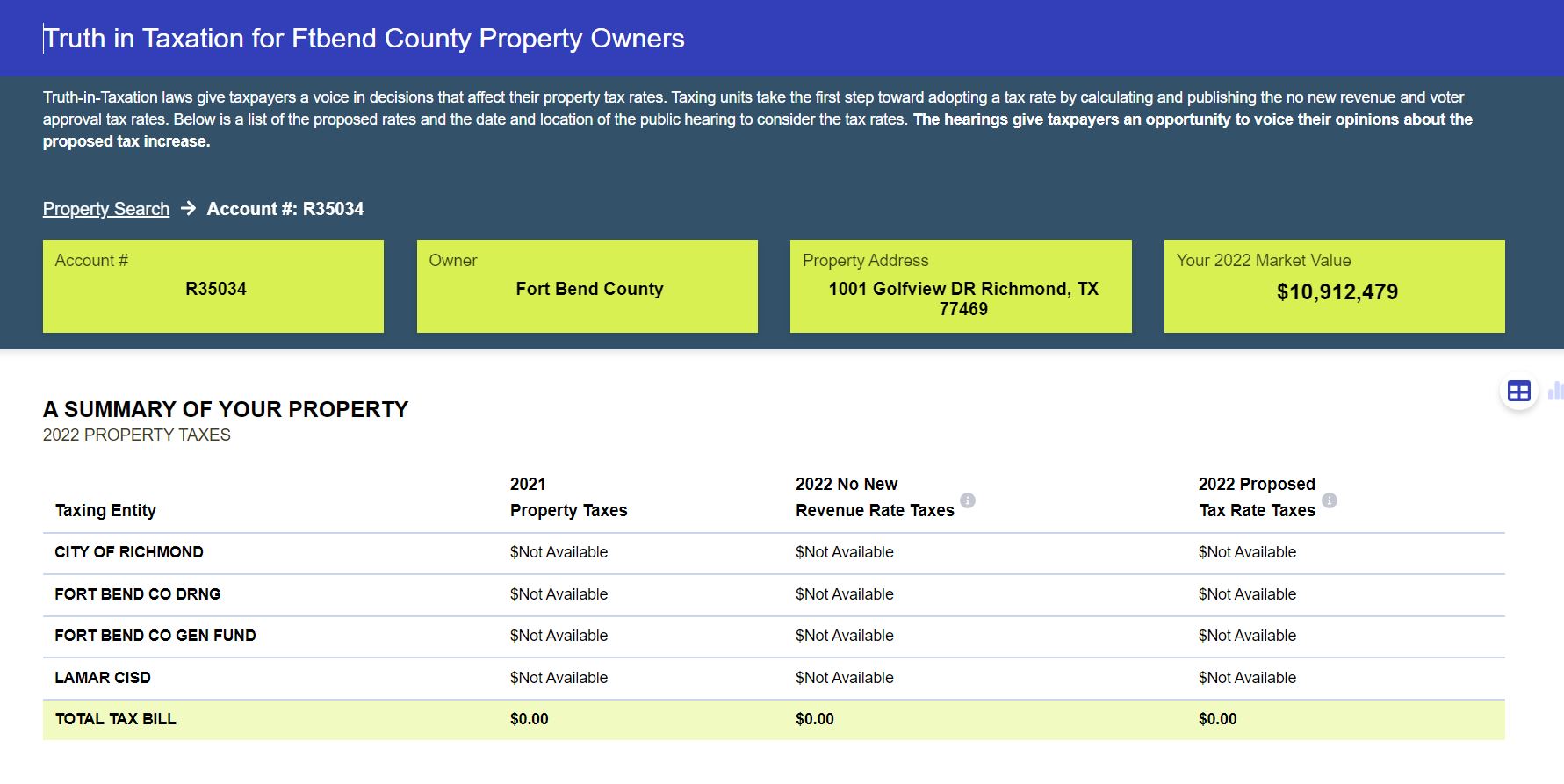

Property Taxes In Texas This Is How To Check How Much You Re Paying Where Your Money Is Going Your Proposed Rate

Real Property Services Cayuga County Ny

Issue 1 The New York City Property Tax System Discriminates Against Residents Of Majority Minority Neighborhoods Tax Equity Now

Richmond Sees Another Year Of Double Digit Percentage Increases In Property Tax Assessments

Richmond To Maintain Real Estate Tax Rate After Considering 6 5 Cent Rollback To Offset Rising Property Values Richmond Latest News Richmond Com

Issue 1 The New York City Property Tax System Discriminates Against Residents Of Majority Minority Neighborhoods Tax Equity Now

City Council Poised To Maintain Current Real Estate Tax Rate Richmond Free Press Serving The African American Community In Richmond Va

British Columbia Property Tax Rates Calculator Wowa Ca

Lubbock City Council Adopts Amended Budget No New Revenue Tax Rate

Richmond Property Tax How Does It Compare To Other Major Cities